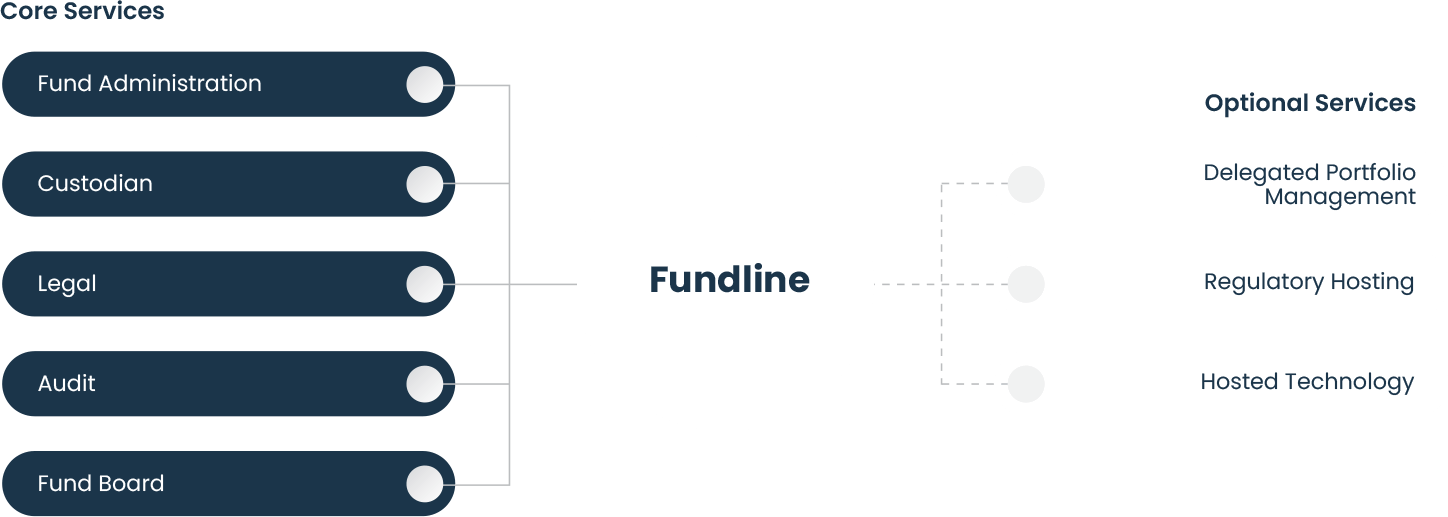

How it works

Fundline provides a simplified structure that is effectively a one stop shop. It keeps each fund legally distinct from other funds and from the umbrella structure itself, ensuring shareholders’ liabilities are restricted to the fund into which they invest. Fundline achieves substance through economy of scale and shared resources. The reduced costs come from consolidating administrative functions across all funds.

- Economical to set up and run

- Quick to market

- Service providers pre-loaded

- Options to tailor additional services

The Fund Structure

The Fundline structure is comprised of a number of individual funds (protected cells). Fundline is regulated (as an open-ended Class B scheme) by the Guernsey Financial Service Commission (“GFSC”). Each fund is legally distinct from other funds and from the umbrella structure itself. There are several advantages to this set up:

- Administrative functions are consolidated across funds

- Shareholder liabilities are restricted to the fund in which they invest

- Allows funds to be priced to suit client’s needs

Who uses Fundline?

Fundline serves client firms seeking a dedicated fund cell at an affordable price. These clients typically require efficient, low-cost feeder funds that are Non-UCITS, yet regularly priced and liquid — often structured as a ‘Fund of One’. They are also often discretionary fund managers in need of a unitised product, or single and multi-family offices seeking a streamlined, cost-effective solution.’

Why Guernsey?

Guernsey has a robust regulatory framework and the Guernsey Financial Services Commission (GFSC) is known for its high standards of supervision and compliance. It has political and economic stability, a well-established financial ecosystem and innovative legal structures. Guernsey’s tax-neutral status for investment funds enhances investor returns and supports cross-border fundraising.

What will we need from you?

First we will discuss an outline of your strategy and the instruments you will look to invest in. Then, we will request your starting AUM and your expected AUM after 12 months, the concentration levels within your portfolio, the number of holdings, expected turnover and the number of transactions per month. Finally, an overview of the jurisdiction and numbers of your target investor group.

“Fundline provides us with a simple, straight forward solution.”